Company news

179 Ships! Prices and Quantity Increase Together! Latest Global Shipbuilding Industry Monthly Report

The number of newly signed orders increased by 72 ships from the previous month, with Chinese shipbuilders receiving the most orders and South Korea second.

According to the latest statistics from Clarksons (as of July 8, 2024), there were 179 new orders signed globally in June 2024, totaling 5,969,350 CGT. Compared with 107 new orders signed globally in May 2024, totaling 2,358,481 CGT, the number increased by 72 ships month-on-month, and the modified gross tonnage increased by 153.10% month-on-month. Compared with 287 new orders signed globally in June 2023, totaling 5,440,172 CGT, the number decreased by 108 ships year-on-year, and the modified gross tonnage increased by 9.73% year-on-year.

In terms of ship types, there are 27 bulk carriers with a total deadweight tonnage of 4,741,000; 29 oil tankers with a total deadweight tonnage of 3,872,396; 28 chemical tankers with a total deadweight tonnage of 1,117,100; 49 container ships with a total of 570,122 TEUs; 10 liquefied gas tankers with a total of 1,474,000 cubic meters; 23 other ship types with a total of 414,524 CGT; and 13 offshore engineering vessels with a total of 191,533 CGT.

In terms of order types, 6 VLOCs, 10 Capesize bulk carriers, 1 Kamsarmax bulk carrier, and 10 handysize bulk carriers were newly signed for bulk carriers; 6 VLCCs, 3 Suezmax tankers, 11 Aframax tankers, 4 Panamax tankers, and 5 small tankers were newly signed for oil tankers; 39 post-Panamax container ships, 4 Panamax container ships, and 6 sub-Panamax container ships were newly signed for container ships.

In terms of the countries of the shipyards receiving the orders, there were 179 new ship orders in June, totaling 5,969,350 CGT. Among them, Chinese shipyards received 125 ships, totaling 4,341,440 CGT; Japanese shipyards received 3 ships, totaling 45,268 CGT; and Korean shipyards received 30 ships, totaling 1,294,904 CGT. The modified gross tonnage accounted for 72.73%, 0.76% and 21.69% of the global new ship orders respectively.

In the first half of 2024, there were 1,127 new ship orders with a total deadweight tonnage of 71,152,820. Compared with 1,368 new orders with a total deadweight tonnage of 62,062,059 in the same period of 2023, the number of ships and deadweight tonnage decreased by 17.62% and increased by 14.65% year-on-year respectively.

In terms of ship types, there are 206 bulk carriers with a total deadweight tonnage of 19,975,590; 149 oil tankers with a total deadweight tonnage of 23,796,479; 187 chemical tankers with a total deadweight tonnage of 5,659,744; 97 container ships with a total of 886,705 TEUs; 142 liquefied gas tankers with a total of 17,487,400 cubic meters; 166 offshore engineering vessels with a total of 1,031,063 CGT; and 180 other ship types with a total of 3,007,578 CGT.

From a country perspective, China signed new orders for 705 ships, totaling 18,068,882 CGT; Japan signed new orders for 42 ships, totaling 697,156 CGT; South Korea signed new orders for 170 ships, totaling 7,163,180 CGT; their modified gross tonnage accounted for 64.31%, 2.48% and 25.50% of the global new ship orders respectively.

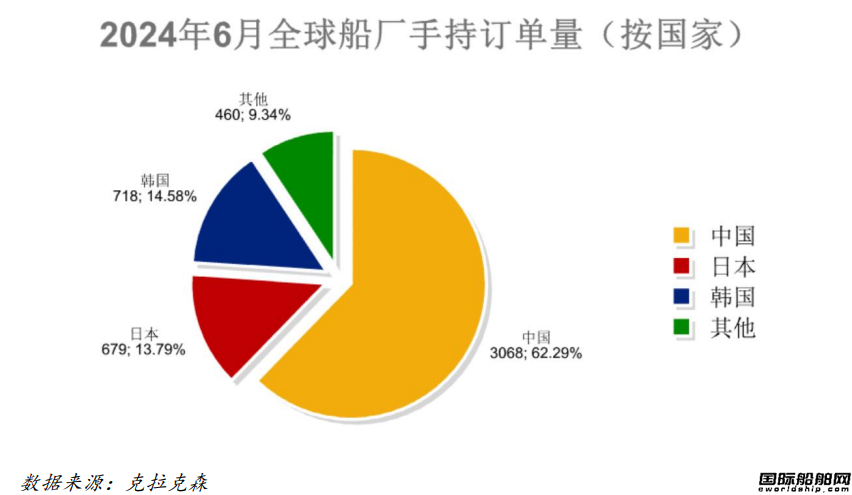

The global order book is 4,925 ships, of which 3,068 ships are from Chinese shipyards, accounting for 62.29% of the global market share.

According to statistics, as of July 8, 2024, the global shipyards have 4,925 orders in hand, totaling 133,354,144 CGT. Compared with the 4,999 ships and 134,713,724 CGT counted on June 8, 2024, the number of orders in hand decreased by 1.48% month-on-month, and the modified gross tonnage decreased by 1.01% month-on-month.

Among them, Chinese shipyards have 3,068 orders in hand, totaling 71,772,197 CGT, accounting for 62.29% of the global market share in terms of number of ships and 53.82% of CGT; Japanese shipyards have 679 orders in hand, totaling 12,490,332 CGT, accounting for 13.79% of the global market share in terms of number of ships and 9.37% of CGT; Korean shipyards have 718 orders in hand, totaling 38,613,315 CGT, accounting for 14.58% of the global market share in terms of number of ships and 28.96% of CGT.

In terms of major ship types, the number of orders for bulk carriers on hand is 1,243, with a total of 98,295,113 deadweight tons; the number of orders for oil tankers on hand is 1,112, with a total of 78,613,097 deadweight tons; and the number of orders for container ships on hand is 682, with a total of 6,065,776 TEUs.

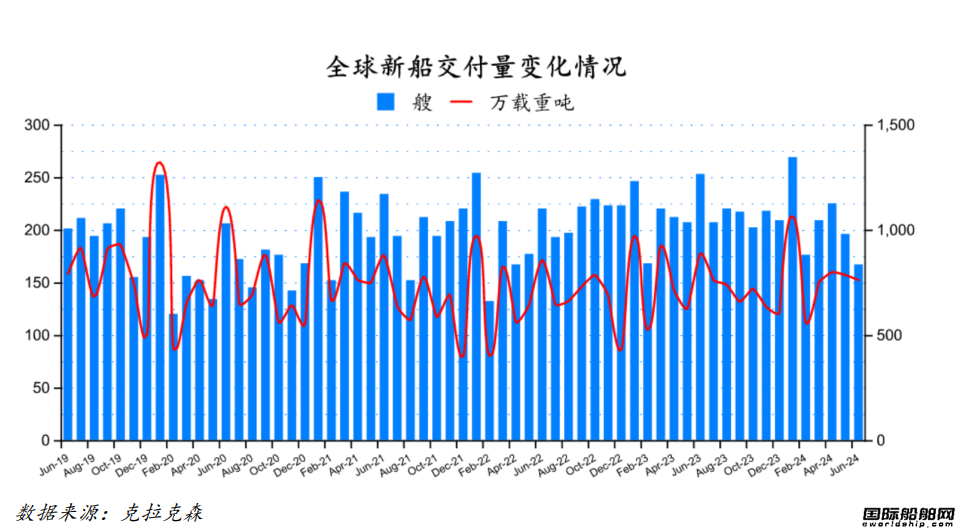

Completion volume decreased by 3.10% month-on-month, with the largest deliveries of oil tankers and container ships

In June 2024, a total of 167 new ships were delivered to global shipyards, totaling 7,641,927 deadweight tons. Compared with the global new ship delivery orders of 196 ships and 7,886,179 deadweight tons in May 2024, the number decreased by 14.80% month-on-month and the deadweight tonnage decreased by 3.10% month-on-month. Compared with the global shipyards delivered a total of 253 new ships and 8,933,614 deadweight tons in June 2023, the number decreased by 33.99% year-on-year and the deadweight tonnage decreased by 14.46% year-on-year.

In terms of ship types, 40 bulk carriers were delivered, with a total deadweight tonnage of 3,424,533 tons; 47 container ships were delivered, with a total of 283,513 TEUs; 5 oil tankers were delivered, with a total of 149,654 deadweight tonnage; 9 chemical tankers were delivered, with a total of 176,663 deadweight tonnage; 6 liquefied gas tankers were delivered, with a total of 696,503 cubic meters; 36 offshore engineering vessels were delivered, with a total of 67,416 deadweight tonnage; and 24 other ship types were delivered, with a total of 197,582 deadweight tonnage.

In the first half of 2024, global shipyards delivered a total of 1,242 new ships with a total deadweight tonnage of 47,399,060 tons. Compared with the global new ship delivery orders of 1,306 ships with a total deadweight tonnage of 46,662,596 tons in the same period of 2023, the number decreased by 4.90% year-on-year, and the deadweight tonnage increased by 1.58% year-on-year.

In terms of ship types, 254 bulk carriers were delivered, with a total deadweight tonnage of 19,049,763 tons; 267 container ships were delivered, with a total of 1,661,818 TEUs; 53 oil tankers were delivered, with a total of 2,477,872 deadweight tonnage; 59 chemical tankers were delivered, with a total of 1,313,376 deadweight tonnage; 59 liquefied gas tankers were delivered, with a total of 5,782,117 cubic meters; 349 offshore engineering ships were delivered, with a total of 917,237 deadweight tonnage; and 201 other ship types were delivered, with a total of 1,383,363 deadweight tonnage.

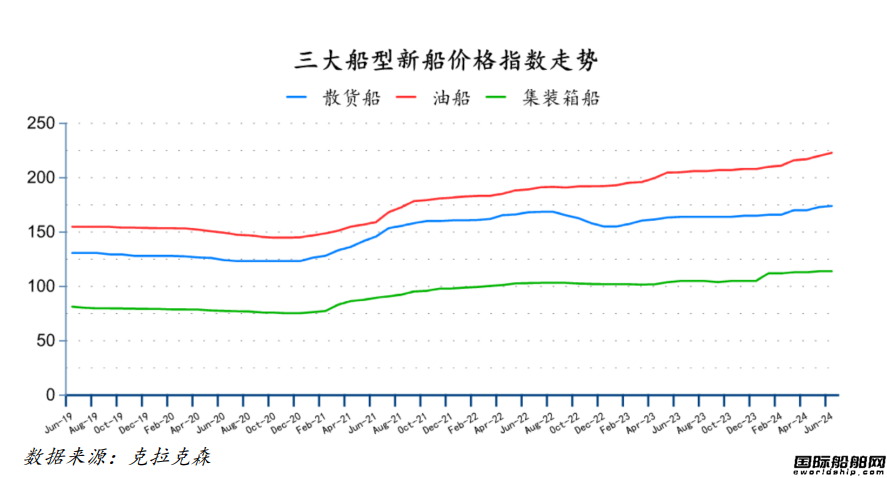

Bulk carrier and tanker newbuilding prices rise, container ship prices remain flat

In June, the price index for new bulk carriers and oil tankers increased by 1 point and 3 points month-on-month to 174 points and 223 points respectively; the price index for new container ships remained unchanged month-on-month at 114 points.

In June, except for the Capesize bulk carrier (176/180KDWT) and Panamax bulk carrier (75/77KDWT) new ship prices increased month-on-month, the prices of other types of bulk carriers remained the same month-on-month. Among them, the prices of Capesize bulk carrier (176/180KDWT) and Panamax bulk carrier (75/77KDWT) new ship prices increased by US$2 million and US$250,000 month-on-month to US$76.5 million and US$36.25 million respectively, and the prices of handysize bulk carrier (61/64.5KDWT) and handysize bulk carrier (25/30KDWT) new ship prices were US$34 million and US$27.38 million respectively.

With regard to the newbuilding prices of oil tankers, except for VLCC (315-320KDWT) which remained unchanged month-on-month, the prices of other types of oil tankers all increased month-on-month, among which the price of VLCC (315-320KDWT) was US$130 million; the prices of Suezmax oil tankers (156-158KDWT), Aframax oil tankers (113-115KDWT), Panamax oil tankers (73-75KDWT) and Handysize oil tankers (47-51KDWT) increased by US$1 million, US$2 million, US$1 million and US$500,000 to US$89.5 million, US$75 million, US$62 million and US$52 million respectively.

As for the new container ship prices, except for the new ship prices of sub-Panamax container ships (2600-2900TEU) and handysize container ships (1850-2100TEU and 1000-1100TEU), which remained unchanged month-on-month, the new ship prices of other types of container ships all increased month-on-month, among which the new ship prices of sub-Panamax container ships (2600-2900TEU) and handysize container ships (1850-2100TEU and 1000-1100TEU) were 41 and 53 respectively. The prices of new post-Panamax container ships (22,000-24,000 TEU and 13,000-13,500 TEU) and Panamax container ships (7,500-8,500 TEU and 3,500-4,000 TEU) increased by US$1 million, US$1.25 million, US$1 million and US$750,000 to US$268.5 million, US$177.5 million, US$122 million and US$59.5 million respectively.